XacBank provides youth financial education and savings accounts

September 22, 2010

By Amber Barger, KF12, Mongolia

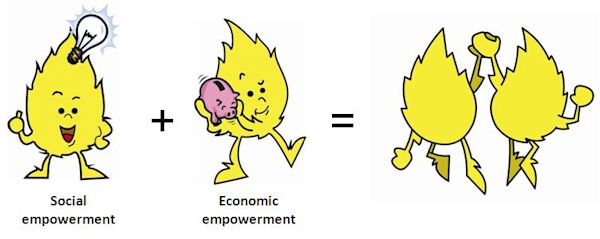

The past five years XacBank, a Kiva field partner, has been providing higher-education loans for university students. The bank has also created a savings account named Future Millionaire, for children under the age of eighteen. More recently, the bank has targeted a younger group of students, as young as eight years old, to provide personal finance and social education. XacBank is currently implementing two youth financial education programs – Aflatoun and Aspire.

The Aflatoun program at XacBank is based on materials provided from the Aflatoun international program. The motto of Aflatoun is to “Separate fiction from fact. Explore, think, investigate and act.” The program is based upon eight modules which encourage primary and secondary school students to learn by doing through fun games, activities, songs and workbooks. XacBank’s Aflatoun program is just in its pilot stage now, however it has a goal of reaching 8,100 students at 90 schools across Mongolia by 2012. The training of eighteen regional master trainers is finished and the training of teachers nationwide will happen this week in Ulaanbaatar. By October 1st, the Aflatoun pilot program will be implemented in ten communities across Mongolia.

Tэмүүлэл, known as aspiration in English, is the name of the Aspire program in Mongolian. In early 2009, XacBank began collaborating with Women’s World Banking, The Nike Foundation, and Microfinance Opportunities (MFO) to research the behaviors and attitudes of Mongolian girls and families towards financial products and education. The research findings helped to create a financial education program focused specifically on Mongolian girls aged 14-18 in secondary schools and at-risk girls who work in the community. For more information about how this Aspire program was initially researched and developed, feel free to read a very interesting case study written by Women’s World Banking titled, Product Development for Girls: Girls’ Savings and Financial Education.

The goals of the Aspire program are for teenage girls to:

- Understand the importance of savings and consider it desirable

- Learn savings strategies

- Open formal accounts of which they have control

- Develop a savings habit

In order to reach Aspire’s target market, XacBank teamed up with the Mongolian Education Alliance (MEA) and the Equal Step Centre, a non-government organization (NGO) which works with low-income and working children. The eight week financial education program is disbursed by three methods to reach three target groups:

- Urban girls from ages 14-18 – The MEA trains peer educators from universities to facilitate the training.

- Rural girls from ages 14-18 – XacBank branch staff deliver the training at secondary schools.

- Vulnerable girls who have dropped out of school – The Equal Step Centre integrates the Aspire program into their other activities which help at-risk youth.

All three target groups have access to the Aspire savings account that XacBank developed through market research. By July 2010, the Aspire program had reached 117 secondary schools, 4,800 urban and rural teenage girls and 120 vulnerable girls. Also, by that time, XacBank had 3,288 Aspire account holders.

98 percent of the students who evaluated the training reported that their knowledge and skills about bank services had improved. The most popular activities among the girls included: calculating interest, visiting a bank branch, learning how to open a bank account, and budgeting. The participants are now paying more attention to their spending decisions, are more carefully considering what they spend their money on, how often they spend money and the consequences of these costs. The girls reported an increased savings behavior at home, and used the money they saved to make their own purchases (i.e. birthday gifts for friends, mobile phone units) instead of asking their parents for the money. All respondents said, in post tests, that they were more confident asking questions at a bank and that the bank is a safe place to keep money.

XacBank has been happy with their initial venture into providing financial education for youth. Although, financial education is not XacBank’s primary function, they would like to see it as a sustainable service that they offer. The staff sees how youth financial education fits into the bank’s overall mission, such as increased product uptake, an improved image of the bank, and better service to their clients and future clients.

Click to view slideshow.Please lend to entrepreneurs in Mongolia and read other posts related to education and microfinance on the Kiva Fellows Blog.

—-

Amber Barger is currently serving as a Kiva Fellow in Mongolia. She has lived for the past two years in rural Mongolia as a community economic development Peace Corps Volunteer. Along with her Kiva Fellowship, she is extending a third year with the Peace Corps as a Peace Corps Volunteer Leader.

PREVIOUS ARTICLE

The Cost of Clothing in Armenia →NEXT ARTICLE

Working to Closer Tolerances, Observation #2 →