By Jeremy Gordon, KF11 and Rachel Brooks, KF10, Kenya

“Esther Keino hopes Juhudi will consider giving loans without requiring solidarity groups in future as group lending is sometimes discouraging because not all members are reliable.”

“Peter is grateful Juhudi Kilimo is focusing on the rural poor who would otherwise have limited or no access to capital. He likes the funding for dairy cows as it is not just for financial purposes but also for social purposes, as it improves the health of families.”

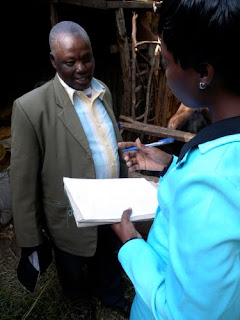

Kiva entrepreneurs can often be a little uncomfortable answering even some of the basic questions for a Kiva profile. Yet at the end of an interview, when Juhudi Kilimo loan officers ask if clients have any other comments, the clients often noticeably relax and open up with quite a few other comments.

Kiva Coordinator Christine Odongo says, “We want to know everything our customers have to say. The feedback is good for us. Then we know exactly what they need and the kind of products they want.” Describing how it feels to get positive feedback she says, “Whoo! Very good. We post that profile right away without reading it twice. But if the comments are negative, I’m sure to share it with our Director of Operations first so he can know what the client thinks.”

Director of Operations Albert Onchiri gave us this example about some less-than-enthusiastic feedback he received from a Juhudi client: a Juhudi client received a loan for a chaff cutter and “immediately after completing repayment of the loan, the animal got sick and passed away. ‘Why didn’t you advise me to get a second dairy cow instead, rather than a chaff cutter?’ the client asked us.” Mr. Onchiri consented that, “It’s our responsibility to make sure that the animal is properly stocked. Having a chaff cutter for just one dairy animal may not make business sense.”

The most common types of negative feedback that come up in borrower interviews are complaints about interest rates and requests for larger loans. Mr. Onchiri responds that, “For interest rates, the management needs more insight on what’s happening in the market. We’re not in direct competition with the commercial banks. [Some commercial banks’] interest rates are very fair, but their scale allows them to spread their costs. As a small microfinance institution, we need to compare ourselves to other MFIs working in the same region.” Mr. Onchiri said that many of the clients are well aware that other institutions sometimes offer better rates than Juhudi but they told him, ‘We cannot leave Juhudi until we start seeing [name of commercial bank] as Juhudi.’ [Our clients] want to see an institution that’s involved in their activities, where the staff follows up about the health of the animal, notifies them of expiration dates for insurance premiums, etc. This is an added advantage for Juhudi.”

In response to the desire for larger loans, Mr. Onchiri says, “We need to have that history—-to understand how you’re developing your cash flows. It’s our policy, and this policy is based on the fact that we want to have a relationship with you. If you want to build this relationship, take a smaller loan and repay in nine months.”

Below is a selection of other client feedback that Juhudi has posted with their Kiva profiles.

Betty Kakhasa is thus far very pleased with her association with Juhudi Kilimo/Kiva. She is proud of the changes she has witnessed in her own family and her town, and hopes that one day all of her needs will be met through continued cooperation with Juhudi/Kiva.

Joyce Cheruiyot would like Juhudi to reduce the interest rate on loans and re-introduce grace periods on second loans.

Peris Karuru says Juhudi Kilimo is really helping low-income farmers unlike other financial institutions.

Peter Nchore requests that Juhudi reduces their interest rates to make it affordable to farmers and to increase the size of loans offered.

Julia Kamau says that Juhudi groups are different from any other since they organize trainings for small scale farmers on how to do farming as a business.

Jeremy Gordon and Rachel Brooks are Kiva Fellows and are working with Juhudi Kilimo in Nairobi. This story was originally posted on "Kiva Stories from the Field" on July 27, 2010. To see the original post, please click here.

PREVIOUS ARTICLE

A blog can only give you so much →NEXT ARTICLE

In The Words of Our Clients – An SMS Journal Pilot in Kenya →