Meet Kristina!

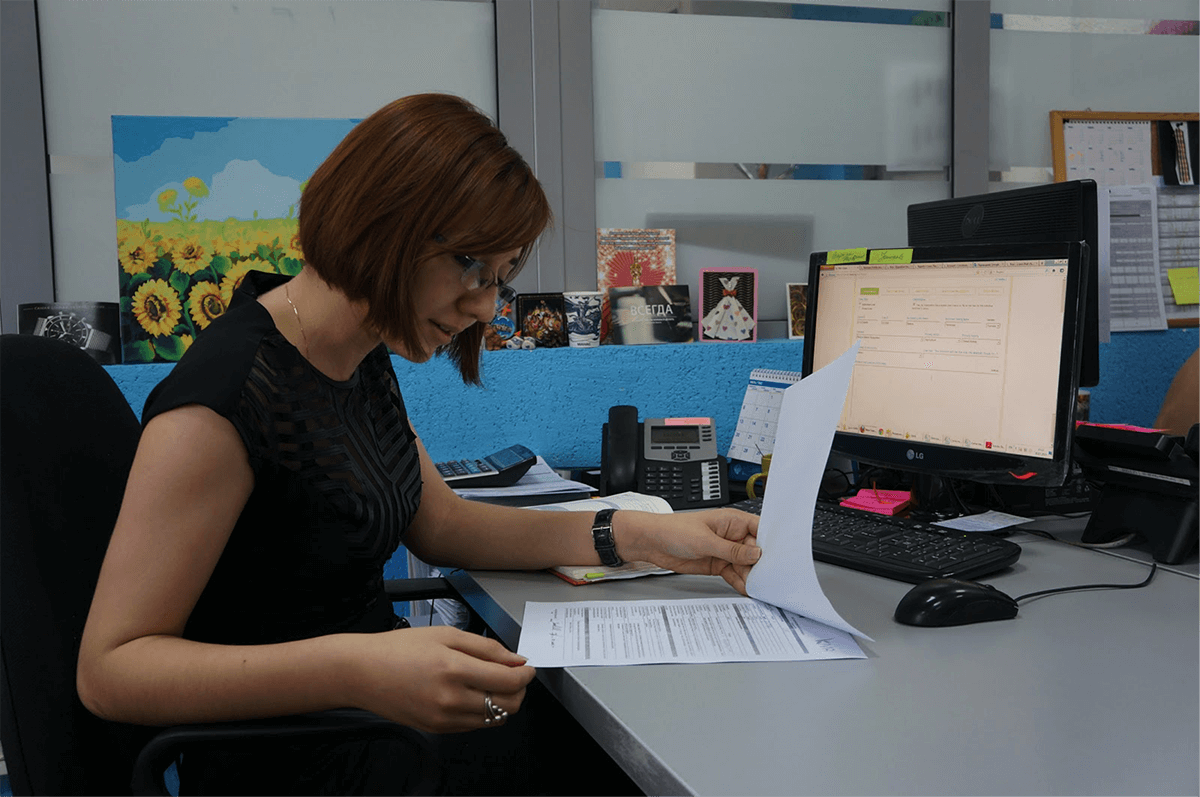

She is the Kiva Coordinator at Bai Tushum, one of Kiva’s Field Partners in Kyrgyzstan. Recently, I had the chance to sit down with Kristina in her office and walk through her process for posting a loan.

Getting the info she needs

Kristina relies on about 190 Loan Officers who are spread out amongst Bai Tushum’s 7 branches and 40+ sub-branches to find the borrowers that she will post and collect the correct information about each of them.

Keeping this many people up to speed on Kiva policies and requirements is no easy task. She relies on the welcome training that new loan officers receive and a yearly refresher training for all loan officers.

The loan officers have to compile 4 documents to send to her:

1. The Kiva Questionnaire - Loan Officers input all the basic facts about the borrower in this document such as age, gender, number of children and loan use. They also have more open-ended fields for information about the borrower’s business and family life. There is even a field for the Loan Officer to describe the borrower’s character (eg hard-working, agreeable), which helps Kristina add detail to the profile.

2. The Client Waiver- This is a legal document that all borrowers must sign before their loan can be on Kiva. Loan Officers at Bai Tushum say that one of the hardest parts of signing a borrower up to be on Kiva is explaining what the waiver means and how the borrower’s information and photo will be used.

3. Repayment Schedule- This will be used to track the details of the loan repayments.

4. Photo- Loan Officers also report trouble getting good photos of the borrower. Often they are meeting at Bai Tushum’s office not the borrower’s house so they need to arrange a special visit to get a good photo of the borrower with her livestock or business.

Posting the loan

Kristina then logs into Kiva’s Partner Admin System. Once she’s in, the first thing she looks at is the amount Bai Tushum has raised on the Account Page. She keeps a meticulous daily log of this number so she can easily calculate how much they have raised since the previous day.

Next she checks to see if any loans have expired and does a quick review of the amount of funding still available to Bai Tushum.

Then, she’s ready to post a new loan. She’s very strategic about the order in which she posts loans. Some of Bai Tushum’s loan products on Kiva are post-disbursed, and some are pre-disbursed. Since the borrowers with post-disbursed loans are waiting for their loan to fund on Kiva in order to get their loan, Kristina always tries to post these before any pre-disbursed loans so that they will be first in the translation queue.

She checks all the documentation and information about the new borrowers, then she writes the description for the loan in Russian using the information the Loan Officer sent her. She said she focuses on the key facts and added that “it shouldn’t be too long. Lenders don’t have time to read that much.”

She adds the loan amount, disbursement dates, repayment schedule and the photo. Usually the Loan Officers send her a few photos and she picks the one that she thinks is best. She hits publish and sends it over to Kiva’s system for translation and review. From start to finish it takes her about 10 minutes to post one loan. Then she repeats this process for 10-15 more loans in a given day.

Kristina runs a tight (and very organized) ship. I think other Kiva Coordinators could learn a lot from her, and I hope someday they will.

PREVIOUS ARTICLE

Why One Mexican Farmer Got Her Whole Town Hooked On Worms →NEXT ARTICLE

The Dust of Africa →