On Committment, Hope and the Meaning of Wealth; A Kiva Fellow’s Perspective

July 17, 2009

By Nancy Tuller,

By Nancy Tuller,

Kiva Fellow Class 8, Ghana, Africa

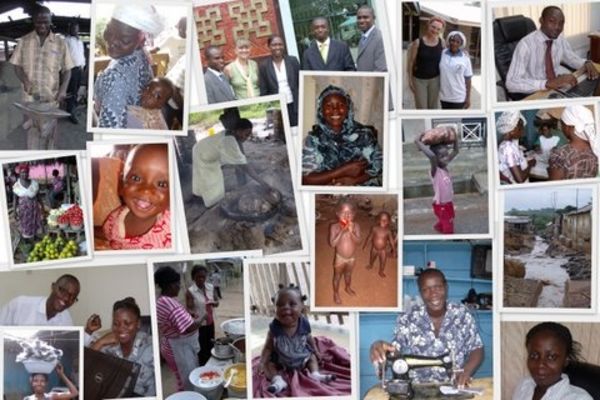

As a Kiva Fellow in Ghana, Africa, I have been working with Sinapi Aba Trust (SAT), established in 1994 and based in Kumasi, the heart of the Ashanti region. Sinapi Aba, as the non-governmental organization (NGO) is often referred to, has a vision of dedication to the building of a nation in which the strong help the weak and people’s dignity is maintained through their own efforts at providing for themselves, their families, and their community. The NGO aims to do this through the provision of both financial and non-financial services to the economically active poor in ten regions of Ghana. It currently serves over 76,000 clients from 40 branch offices spread throughout these regions. Your loans to Sinapi Aba clients are helping Sinapi Aba to come closer to the realization of its vision through expanding the reach of microloans in Ghana.

In addition to offering microloans, Sinapi Aba offers its clients business training, social service and consultancy services, as well as training in wise credit usage, vocational skills, savings, accounting and record keeping, and customer service. Its non-financial services include capacity building, training and technical advice to other microfinance institutions, along with client-oriented programmes in HIV/AIDS awareness and community development, and a very successful youth apprenticeship programme. Sinapi Aba Trust staff is comprised of some of the most dedicated and committed individuals I know. Their salaries are not handsome by any measure. They do this work because they believe that their actions should reflect their belief in, and commitment to, serving others. Their passion to stay true to their mission of serving the economically disadvantaged in society through providing opportunities for enterprise development and income generation is only surpassed by their successful track record in doing just that.

It is with Sinapi that I have taken my first baby steps in this continent. It is Sinapi staff that has nurtured me with its knowledge, wisdom and love. I adore my Sinapi family, and am beyond finding the right words to convey my gratitude for what I have gained through this experience. Now, all too suddenly, I have to leave my Sinapi family, and move on to my next placement in Ghana. As I ride the bus that takes me further and further from Sinapi and towards my next destination, I find myself reflecting on lessons learned. Each time in my life that I have put myself in unfamiliar territory and just opened up to learning whatever comes to the front, I have walked away with a little more wisdom…the kind that never comes in textbooks. Those books will tell you that Ghana is a poor country. But I am telling you that Ghana is one of the wealthiest countries I’ve ever been to. The “poor” loan clients that SAT lends to are some of the most wise, strong, resourceful, humble, kind, loving, and giving people I have ever met. That is wealth beyond compare. I am the poor one: the one who is indebted to both staff and clients for sharing their hearts, their wisdom and their lives with me.

I was fortunate enough to witness the positive impacts that the small loans offered by Sinapi Aba can have on loan clients and their families. Take Hannah, for example, a widowed loan client who tends hot fires and ash to make homemade “alata” soap to sell. She is proud that her hard work is sending her two grandchildren, whom she raises, to school. She sacrifices so that they may have the opportunities that she did not. Or Esther, a determined young divorcee who has successfully started three different ventures (selling porridge in the mornings, tailoring clothes in the afternoons and selling fabrics to other vendors in between), all to make her dream of sending her gifted daughter to university come true. Recently I visited a village where at least half of the loan clients were widows, raising their families by themselves; slowly building their businesses and invariably putting their children’s education before anything else. Or how about Stella, who told me that education is the greatest legacy she can leave her children?

The women and men I have met are both Christian and Muslim; Twi, Akan, and Hausa speakers, with roots from different regions and tribes. In many ways they differ, but just about all the loan clients I have met have expressed the same shared value for education. They recognize that education is the key that will unlock doors for the next generation, and they are determined to give their children that opportunity: one that most of them never had. It is this simple kind of wisdom and loving generosity that makes Ghanaians rich beyond compare. The generous spirit of Ghanaians is expressed in many ways. You know, in the more remote rural areas of Ghana, where people still commonly use bartering systems and the concept of money has not yet caught on as well, people will open their homes to others in need. One who has an empty room in their house might offer it to another who has no home. This is done without expectation of anything in return, ever. In both urban and rural areas, the custom remains that when you are eating something, and another person comes along, you should invite him or her to partake of your food by saying, “You are welcome”. Younger persons rush to carry the loads of older persons almost without exception.

The women and men I have met are both Christian and Muslim; Twi, Akan, and Hausa speakers, with roots from different regions and tribes. In many ways they differ, but just about all the loan clients I have met have expressed the same shared value for education. They recognize that education is the key that will unlock doors for the next generation, and they are determined to give their children that opportunity: one that most of them never had. It is this simple kind of wisdom and loving generosity that makes Ghanaians rich beyond compare. The generous spirit of Ghanaians is expressed in many ways. You know, in the more remote rural areas of Ghana, where people still commonly use bartering systems and the concept of money has not yet caught on as well, people will open their homes to others in need. One who has an empty room in their house might offer it to another who has no home. This is done without expectation of anything in return, ever. In both urban and rural areas, the custom remains that when you are eating something, and another person comes along, you should invite him or her to partake of your food by saying, “You are welcome”. Younger persons rush to carry the loads of older persons almost without exception.

My time here with Sinapi Aba Trust has been well spent. I have learned about the economic challenges that face so many in Ghana, and I’ve seen for myself how small loans can help people to face and overcome those challenges, and even prosper. I haven’t seen anyone get “rich” from the provision of microloans, but wealth is a relative term by any measure, and not best determined through the eyes of the beholder. I saw some loan clients who could have handled their finances better, and some who, despite good business sense, struggle to stay afloat in the current inflated economy. I have been reminded that rising above abject economic poverty is a slow and gradual process. Each small loan brings with it a small, but positive change in a family’s life: better food, a first pair of shoes, no more lapses in education because the school fees can’t be paid, a second small business. Through it all runs a common thread of hope. Much like a glittering gold thread that bobs in and out of the fabric of thousands of lives, Sinapi Aba Trust has given new light and new hope to tens of thousands of loan clients in Ghana, and is working hard every day to reach more.

In retrospect, one of the lessons I have learned here has been a deepening of my understanding of the meaning of wealth. When I asked one client whether she considered herself to be poor, she answered that no, she had her family around her, and enough to eat, and this is all she needs to be wealthy. Being with such people humbles me to my core, and I can’t help but lament my suspicion that the “poor” west faces daunting challenges ahead, deconstructing the concept of wealth before it can truly recognize that development is as much a human and spiritual endeavor as an economic and political goal. When I look at the Kiva community, though, I take heart. I am especially humbled by all the lenders who have made such a difference in so many lives here in Ghana and elsewhere around the world. I am proud to know that spiritual wealth abounds in all peoples and corners of our world. We really are connected. We really are one people. The rich in spirit are growing, and that awakening is beautifully expressed by Kiva lenders through loans that are making a significant difference in the lives of economically challenged people around the globe. Thank you for your generous spirit that is helping to awaken others and build a more equal and peaceful world on so many levels.

Please join with Sinapi Aba Trust staff, myself and other friends and supporters in our efforts to reach even more deserving loan clients in Ghana and around the world. Learn more about Sinapi Aba Trust at http://www.kiva.org/about/aboutPartner?id=88&_tpg=fb. Then please consider joining our newly formed SAT lending team, Sinapi Aba Trust Ama Anidaso (“Sinapi Aba Trust Gives Hope”), and help us to increase our overall impact on poverty alleviation around the world by making a loan to an entrepreneur of your choice at http://www.kiva.org/team/sinapi_aba_trust_ama_anidaso%25_tpg=fb.

/>PREVIOUS ARTICLE

Map of Kiva in the Philippines →NEXT ARTICLE

Surviving the Transportation Strike in Pucallpa, Peru →