By Eric Rindal – KF15 – Sierra Leone

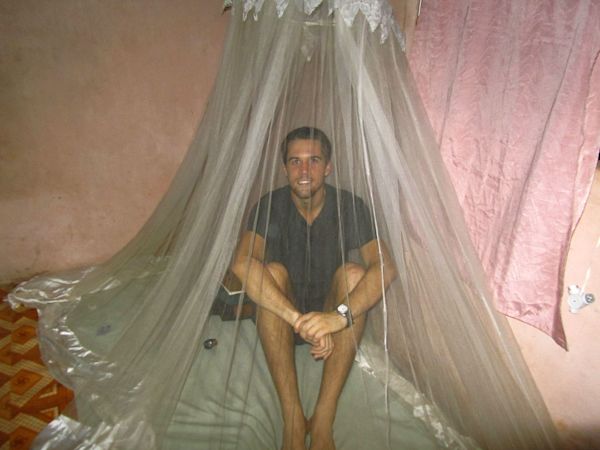

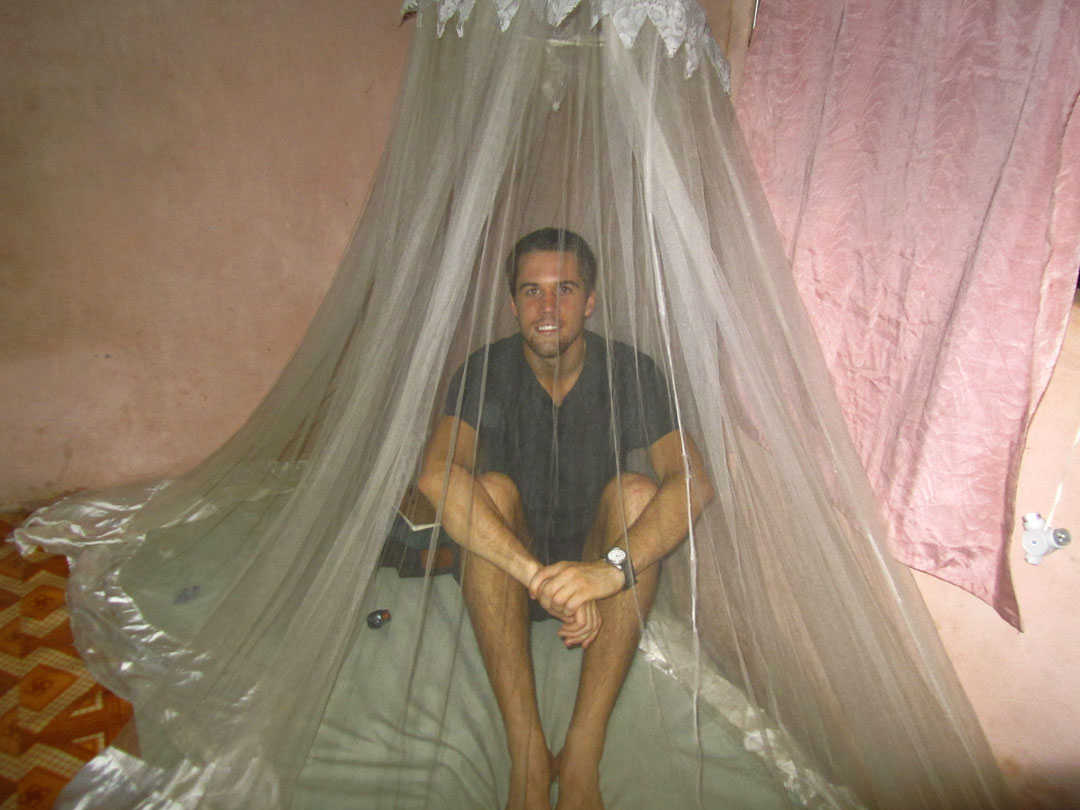

Mosquito nets are an essential part of most, if not all, Kiva Fellows’ experience. From Senegal, to Ecuador, to the Philippians, we all need them; in fact, it would be crazy to sleep without one. I find my faith in these perforated cocoons may actually be deeper and extend further than I thought.

My “mosquito net” used to drape well beyond the four corners of my bed, delicately hanging both as a distance and a shield from poverty. This physical distance fostered a mental distance such that I could safely experience poverty through published journals or between the covers of a book. But it was time. I was determined to come to Sierra Leone and understand poverty and microfinance firsthand. Thus I took a risk and crawled from underneath my net.

It is easy to look at a country and turn away – afraid of what we might see. Turning away is almost like denying the existence of all the faces and stories of poverty. But, when around 53% of Sierra Leoneans live under $1.25/day, the myriad images of quiet destitution are an inescapable reality. We Fellows are not challenged to the same degree as those we live among; yet, by abandoning our nets and taking a slight chance at contracting malaria, we live in a sliver of poverty. Of course there are the nerve-wracking times of traveling alone or other times wondering if I will make it home alive on a motorcycle taxi. But what would Kiva be if it were not living in solidarity with entrepreneurs, if it were not lending its heart and ears to stories, or if it lacked an understanding of how to adapt with the developing world?

Kiva has long since lifted its mosquito net and eagerly began working with MFIs in some of the most politically and socially volatile countries. Take Kiva’s involvement with Sierra Leone for example: a post-conflict country with very few foreigners willing to enter the country and invest. Kiva was the first outside funder (through microcredit loans) for their current partner MFI Salone Microfinance Trust (SMT) in 2007. The visibility Kiva brought to SMT set in motion new donations from three Sierra Leonean organizations: Shine on Sierra Leone, MicroCredit Enterprise, and Feed the Hunger Foundation. In addition to being an influential partner with SMT, Kiva was also the first outside funder for two other MFIs I work with in Sierra Leone, Association for Rural Development (ARD) Sierra Leone and BRAC Sierra Leone. Beyond the impact within Sierra Leone and partner MFIs, Kiva is a progressive force in other areas. I must share a captivating article that I admire by Kiva team members JD Bergeron and Alyssa McGarry on the influence of Kiva’s model which puts focus directly on the borrowers, especially in this case the disabled and marginalized.

Kiva is moving forward as an innovator within the industry of microfinance. They have the capacity and adeptness to take risks in funding entrepreneurs who would find it difficult to be funded otherwise. I encourage you to take notice of organizations who believe in getting out from under their mosquito net, because they are the ones who invest in the new faces of innovation.

I would like to thank Kiva team members Ben Elberger and JD Bergeron for their generous contributions to this post.