Microfinance Information Exchange (MIX) has partnered with Kiva.org to produce a three part series to give our readers a deeper dive into social performance! The series, written by the MIX, will be released weekly for three weeks. This is is the second post, it discusses how to manage social performance!

In our first post, we talked about the importance of tracking social performance metrics in order to improve a microfinance institution’s (MFI) operations and to ensure the fulfillment of its mission. This post provides a more in-depth look at systems and processes that help institutions ensure that they are delivering affordable, accessible, and appropriate products for their clients.

To demonstrate, let’s use the same example institution from our first blog post: an MFI with a clear mission to provide affordable finance to the poorest members of its community. Furthermore, let’s assume that this MFI operates in an environment where high competition has led to a reduction in interest rates and an increase in both staff and client desertion – a realistic scenario that more and more MFIs are facing every day. Our hypothetical MFI now faces a challenge to reduce costs to stay ahead of declining revenues. What should it do to retain staff, lower costs, and continue to serve its target population?

Although no single recipe exists to address these problems, there are some specific steps that an MFI can take to keep both clients and staff satisfied. Monitoring client dropout is a first step towards gaining a realistic notion of the problem’s true dimensions. However, even more important is how an MFI uses such information to improve client retention.

Measuring client satisfaction through market research can help an MFI gauge client demand in order to refine existing products and develop new ones. Not only can this help retain more clients but it can also be quite effective at reaching the right clients. Kiva’s Field Partner NWTF <link>, based in the Philippines, used the Progress out of Poverty Index™ (PPI™) to learn that it was not reaching as many clients from below the poverty line as was prescribed by its mission. NWTF consequently refocused its outreach efforts to increase the number of poor borrowers in its portfolio.

Investing in staff training and progressive human resource policies can improve staff retention, which has a strong relationship with client desertion. Staff training and social performance incentives improve staff productivity (happier staff and staff retention go hand in hand, and both improve productivity), while higher dropouts lower staff productivity (staff members need to spend more time and energy acquiring new clients). When a staff member leaves to work for another MFI, he or she often brings his or her clients along as well, which increases the loss for the MFI. In Latin America, for each staff member who leaves an MFI there are roughly 150 clients who do not have their credits renewed.

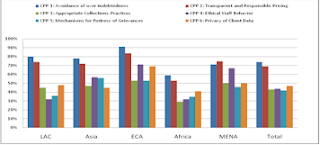

Finally, protecting clients from over-indebtedness and promoting transparent and responsible pricing is essential in competitive environments where clients are likely to have multiple options for financial services. Poor clients must often deal with limited information on products or low financial literacy. Thus it is the MFI’s responsibility to implement transparent operations to protect the rights of clients at the base of the pyramid. To aid in protecting clients, the Smart Campaign has created a series of six Consumer Protection Principles (CPPs) that MFIs can endorse and implement in their operations.

In conclusion, our beleaguered (but dedicated) MFI has an array of policies and strategies available to it to retain both clients and staff. These policies – better human resources management, proper staff training and incentive schemes, market research for measuring client satisfaction, avoidance of client over-indebtedness, and transparent and responsible pricing practices – are at the core of good social performance management. In addition, these policies can trigger a virtuous circle by improving financial performance as well, thus better positioning the MFI to be both more efficient and sustainable in the long run.

Consumer Protection Principles as reported by MFIs to MIX across regions

PREVIOUS ARTICLE

Microfinance Notes: 9 May 2011 →NEXT ARTICLE

Passport Series: South Sudan: Part 2: Microfinance →