As an early innovator of impact crowdfunding, Kiva has a history of making change. Across two decades, Kiva has had rich experiences in delivering financial access to underserved communities and underbanked people around the world. While we’ve reached more than five million people during that time, the opportunities to broaden and deepen our impact have only continued to grow. Delivering impact for the next two decades requires us to continue maturing and innovating our work in new ways.

Redefining our impact

Every journey requires a destination. For Kiva that destination is financial opportunity for all. Yet, when we consider the huge need among the underbanked and underserved around the world, we recognize that there are some communities of people that Kiva should prioritize based on their unique needs for financial services, the opportunity to make a significant impact, and Kiva’s experience working with these communities already.

As we leaned into this impact vision, we refined our theory of change to focus on four important populations that will be the emphasis of our impact in the years to come. At the same time, we recognize that it’s not simply about reaching more people, but also about the way in which we impact them. Key to this impact is an ever-expanding ecosystem that spans the globe, connecting people and communities, driving change, and creating opportunities.

Kiva is committed to expanding financial opportunities globally for millions of underbanked women, refugees and forcibly displaced people, communities vulnerable to climate change, and systemically marginalized communities in the United States.

Leveraging technology, Kiva connects impact-minded lenders and investors with inspired borrowers and innovative local organizations, building a unique ecosystem of financial inclusion that helps people become more resilient and financially independent. This provides support for people to grow impactful businesses, build better futures, and strengthen their communities.

Setting measurable goals for collective impact

Having this refined impact destination articulated was an important first step for Kiva for this next phase of impact. Setting ambitious impact goals has enabled Kiva to bring life to our aspiration for impact and provide more direction for our journey. These goals not only align all of our efforts as an organization, but they enable us to be better partners with our entire ecosystem of lenders, corporate partners, donors, Lending Partners, and borrowers. They enable us to see the vision together, and strive to reach something as a collective that on our own wouldn’t be possible.

By 2028, Kiva will reach:

8 million underbanked women.

1.1 million climate-vulnerable people

We’re using these goals to encourage our Lending Partners to join us on this journey. We’re also inviting lenders, corporate partners, and donors to take on a piece of these goals as their own challenge. It’s a way for us all to have a part to play in a much larger impact narrative.

Measuring our impact effectively

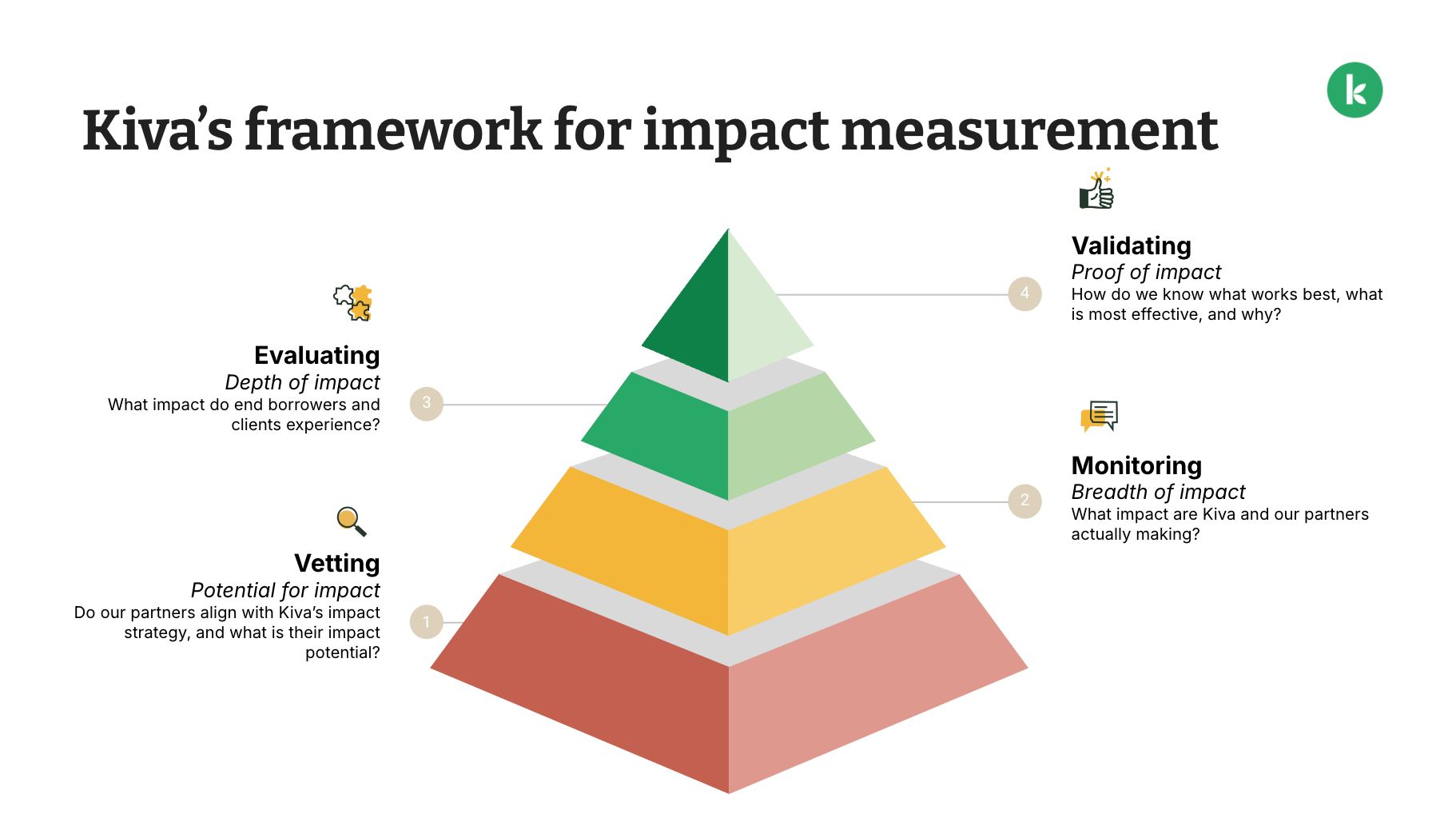

Having impact goals is only an aspiration unless we have the tools to ensure we can reach those goals, and measure our progress along the way. Kiva’s impact framework guides our approach.

This framework includes:

Vetting the potential for impact: ensuring that our partners align with our impact strategy and are equipped to contribute to our impact goals

Monitoring the breadth of impact: measuring how many borrowers we and our partners are able to reach along with what is achieved (outputs)

Evaluating the depth of impact: measuring the impact that borrowers experience (outcomes)

Validating: providing proof of what is most effective and why

Unlocking our partners’ potential

In order to continue deepening our impact and reaching our impact goals, we need the right partners for the journey. Kiva’s Lending Partners have the local knowledge and expertise to drive impact. While Kiva has long had a tool to vet our Lending Partners for their impact potential, having new impact goals gave us the opportunity to enhance this.

We’ve improved our existing Impact Scorecard by incorporating the most recent global standards and best practices, and building in two new important components to assess mission alignment and gender focus.

The Mission Alignment component seeks to understand how Kiva’s Lending Partners will contribute to our impact goals. The Gender Equity Assessment Rating will help us understand how well our partners are focused on gender through their policies, practices, products and services. This improved Impact Scorecard has been rolled out to our entire portfolio of existing partners to establish a new baseline moving forward.

The Impact Scorecard provides Kiva with a view not only of how our partners align with our impact goals but also of their strengths and opportunities for improvement. We’ll use this new data to ensure we have the best network of Lending Partners to achieve our impact goals and to work alongside these important partners in building their capacity so that they can make an even greater impact.

Reaching our goals when everyone counts

Counting who we impact is more complicated than it might seem. Kiva has a number of ways in which loans are made, as well as a variety of types of borrowers, from the individual borrowing a couple hundred dollars to social enterprises borrowing as much as $500k. In both cases, we know that the impact of those loans often goes beyond just the loan recipients themselves.

We’ve sharpened our methodology to ensure we are counting all of those whose lives are touched through a Kiva loan. With this refined methodology, we can better track the progress we are making towards our impact goals.

Collecting what matters to show progress along the way

Alongside the number of lives we touch through Kiva loans, there are a host of interesting facts and figures that we can count to show how our impact goes well beyond the individual. These include figures like the number of solar panels funded, the number of farmers implementing climate-smart agricultural practices, the number of kids sent to school, the number of jobs created, and more. This isn’t always easy, and not all of our Lending Partners are in a position to always collect this data. We’re working to improve the way we collect these metrics so that we can best tell the story of what kind of impact is happening because of our amazing community.

Key to these changes is leveraging what our Lending Partners are already collecting. We’re testing the capabilities of artificial intelligence to help sort through the various types of reporting that our partners already produce, in the hopes that we can use these in place of extracting even more data from already busy partners.

Deepening our impact by magnifying borrower voices

Ledis Esmerelda in El Salvador used her Kiva loan to buy items for her store.

Reaching more people with the right set of partners is only part of the impact we seek to make. Financial access should lead to changes in the lives of those we’re supporting and we’re committed to magnifying their voices to ensure we understand the depth of impact we are making.

Kiva has been partnering with 60 Decibels, an expert in the impact measurement space, for a number of years. We’ve recently deepened that partnership, and now have access to borrower impact data on more than 50 percent of Kiva’s portfolio. That means we get to learn more about what those borrowers are experiencing, and how their lives are changing as a result of the loans they’ve received.

We’ll continue to use this data to work with our Lending Partners to find ways to deepen the impact we’re making in the lives of our borrowers.

Financial access should lead to changes in the lives of those we’re supporting and we’re committed to magnifying their voices to ensure we understand the depth of impact we are making.

Improving our approaches to deliver maximum impact

While impact lending and microfinance are now decades old, they are no less needed. We've made incredible progress in opening financial access to 5 million people, but 1.4 billion people worldwide remain financially excluded. Regardless of how much we think we know, there are always ways to improve how we do what we do, and to learn about what works best and why. This ensures that we continue to grow and make the greatest positive impact.

This is especially true in areas of our work that are more innovative. Refugee lending is one area that Kiva has pioneered. We’ve shown that refugees and displaced people are just as capable of repaying a loan as anyone else. We’re now building on that knowledge to better understand the needs of refugee borrowers, the barriers they face, and to track what types of loan products best meet their needs over time. We’re also in the process of building a climate assessment tool that can help us understand how to work with our Lending Partners in strengthening their climate practices, products and services to better serve borrowers most impacted by climate change.

All of these efforts help us realize our impact vision, and deepen the impact we can make for the next phase of the journey. Kiva is committed to learning and maturing in a way that puts our borrowers first, and recognizes the important role that our Lending Partners play. We’re excited to bring our entire community along on this journey of impact.