Financing Nicaragua's Future: MiCredito's Audacious Goal of Making Higher Education Accessible to the Masses

November 25, 2015

It's a decidedly scorching afternoon in the small pastoral community of Puerto Momotombo, located approximately an hour outside of Leon, Nicaragua's university capital. As part of my Kiva fellowship, I've been traversing the country visiting borrowers and observing firsthand the impact their Kiva loan has had on their lives and livelihoods. In Momotombo I'm meeting with Ana Belkys, one of several Kiva borrowers who have taken out a loan from Kiva field partner MiCredito to fund higher education expenses through its loan product, MiCreditEstudios.

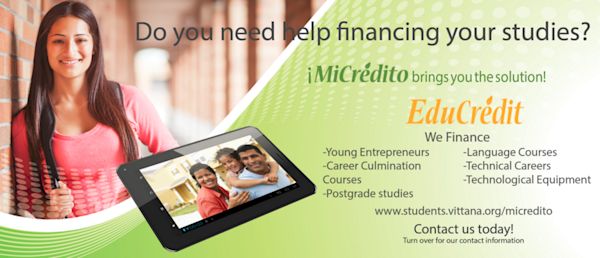

MiCreditEstudios is a student loan product which allows university students to fund the gamut of higher education expenses commonly incurred on the road to graduation. Need to buy a motorbike to make that hour long commute to class slightly less tortuous? Pursuing a technical career and need to buy equipment to carry out your coursework? Require a computer to access the web and more effectively do your homework? From smaller non-tuition expenses to complete funding of the tuition costs for a master’s degree, the scope of expenses eligible for financing is extremely broad.

Aside from the sheer range of university expenses covered, the real differentiator for MiCreditEstudios has been the product's adaptability to the unique financial circumstances of students: a built-in grace period, loan terms of up to five years, and competitive interest rates are all part of the package. As in most places, university students tend to not be the most attractive lending segment from a risk perspective: little to no active income streams during five years of school and then a slow ramp-up over several years until students start to approach their full earning potential (and can feasibly begin to make significant payments on their loans). The extraordinary popularity of MiCreditEstudios since its launch attests to the current lack of financing options for university students in Nicaragua. It also demonstrates the tremendous unmet demand for accessible and adaptable products which meet students' needs.

During my time at MiCredito I was able to sit down with a few MiCreditEstudios clients and hear their stories:

Since taking out her Kiva loan, Ana has finished the final course modules to graduate and obtain her degree in Chemistry and Pharmacy. She is proud of this big step, and is even considering continuing her studies and obtaining a masters degree in Pharmacy and Community Health. One of the additional benefits of the loan for her was "the education she received in budgeting and savings" - when taking out a MiCreditEstudios loan students are eligible to take classes in financial education, open a savings account with an affilate bank, and recieve a low-cost medical examination.

Wiston, a fourth year pre-law student who attends university in Managua, took out a loan to fund his final courses along with a number of administrative proceedings with the government to become an officially registered lawyer and public notary. As with many other Nicaraguan students, cost of final course modules required to graduate can represent significant financial hurdles to officially obtaining a degree.

PREVIOUS ARTICLE

Innovative Loans Series: Loans to Small Growing Businesses Expand Kiva Lenders' Impact →NEXT ARTICLE

Andean Mountain High: a day in Chimbo →