On Friday everyone shows up at the office dressed up. Mostly for religious reasons, but it’s a refreshing reversal of casual Friday. It’s our all-hands day, where everyone from the different parts of Abidjan meets here at 4pm. I saved the chocolates I brought for this day, and shared with everyone. I really enjoy meeting all the field officers- they are truly the heart & soul of this operation. Everyone I have met so far has been enthusiastic and friendly.

It is a hard life here. I walked through the market last night, it’s an open-air market much like you’d see in Mexico, with each vendor selling fruits, veggies, live crabs, raw meat, toiletries, etc. I want to just reach out and buy something from everyone. But of course that’s not the answer. It has to be a sustainable system from within, and the capital from Kiva to augment that system is a much more effective jumpstart and monitored much more closely than if I just go around buying stuff I don’t need!

I sat with the HR women yesterday to count the money from the markets, and talk about their processes. There are two different types of loans, the individual loan and a group loan.

The group loan is for women only, and it is coordinated in groups that start out as 10, and end up around 5-6 women. The women self-select their group, so that they determine to whom they will be accountable. Every woman in the group becomes responsible for the entire payment due each week, so that if someone is missing, the others must make up that amount and be reimbursed later. No three people from the same family are allowed in the same group. This is for many reasons- if there is a funeral in the family, then all three would leave at the same time, leaving the others in the lurch for that week. Or even worse, once they’d taken their share, they could just leave period.

There are two different ways of splitting up the group loans. One way is that one woman at a time gets the whole sum of money, and they take turns. The other is there is a total sum, and it is divided between the women equally. They use an evaluation form on many variables, including how many children each woman has, number of years experience in her field, if she has a criminal record, etc. Each woman fills out this form, and it is rated for risk. They add up the risk points for the group, and determine the loan size, and how it is split among the women. The majority of AE&I’s loans are individual, but the group loan is a good way for a woman to get started and develop credit with the institution. She can then transition to an individual loan. In talking with women in the markets, many of them started with a group loan, but much prefer the individual loans they are now doing. This is for the clear reason that when other members of the group defaulted, they had to pick up the amount.

If the woman hasn’t established her credit in a group loan, then before she can take an individual loan, she must start with a savings account. They meet with the potential client and talk to them about the business, what they would use a loan for, their family circumstances, etc. They explain to them that before they can get a loan, they must open a savings account and contribute a small amount to that savings account on a daily basis. The client determines how much they will contribute to this savings account. Most choose to contribute between 50 cents and two dollars per day.

After three months of diligent payments, AE&I adds up the amount. At any time during those three months if the person wants to withdraw their money, they can do it. But if they leave the money in savings, that serves as the collateral for their first loan, and they can be loaned that exact amount. Only their first loan has this collateral structure. And this is what I find interesting. This first loan is not the transformational loan- it is the screening process for quality clients. And these clients continue to work and expand their business, taking progressively larger loans in small increments. Then, once they feel confident, they can take a relatively larger sized loan, and use it to significantly upgrade their business. It is in this way that AE&I has cultivated a portfolio of trustworthy and thriving clients.

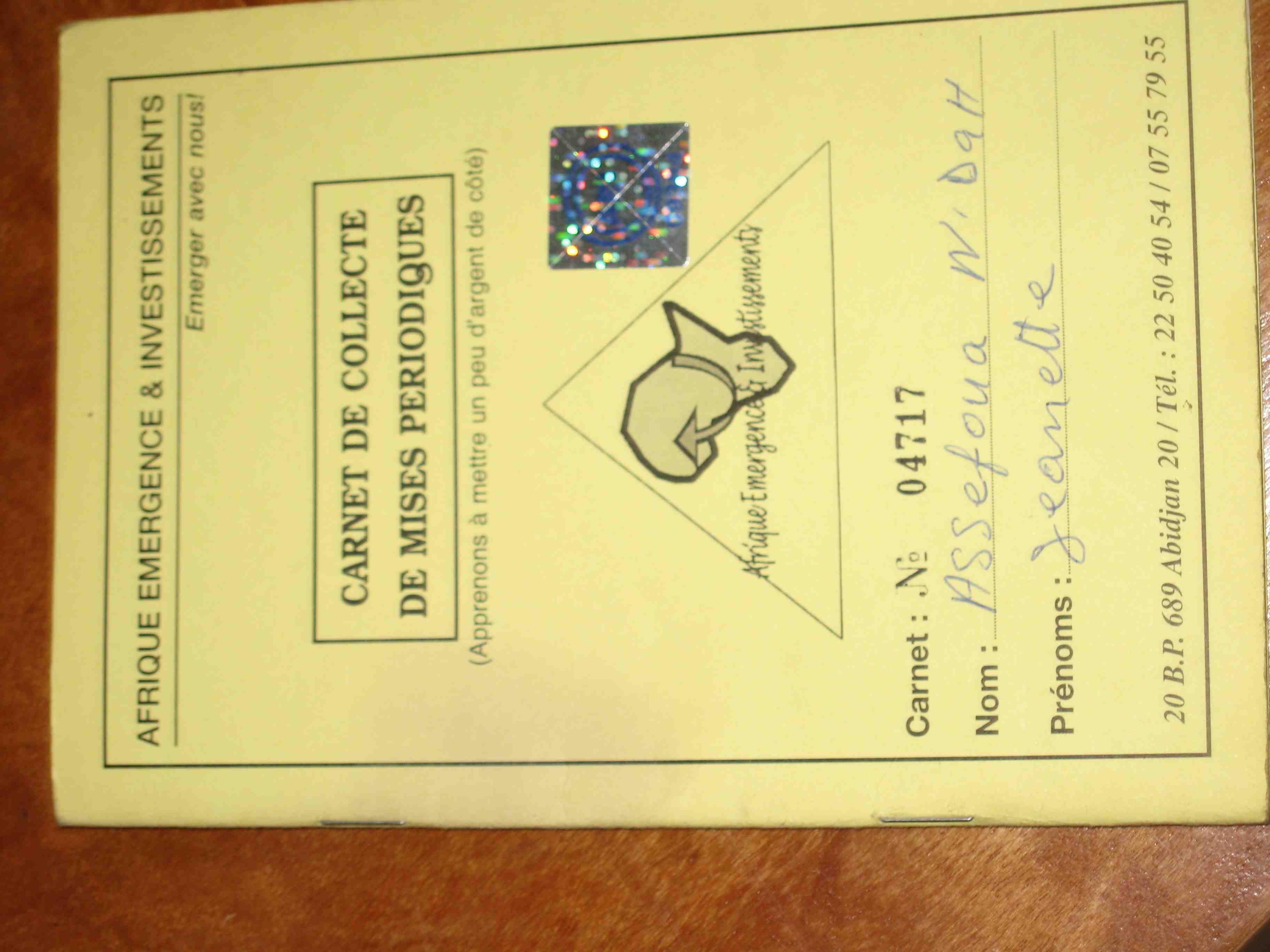

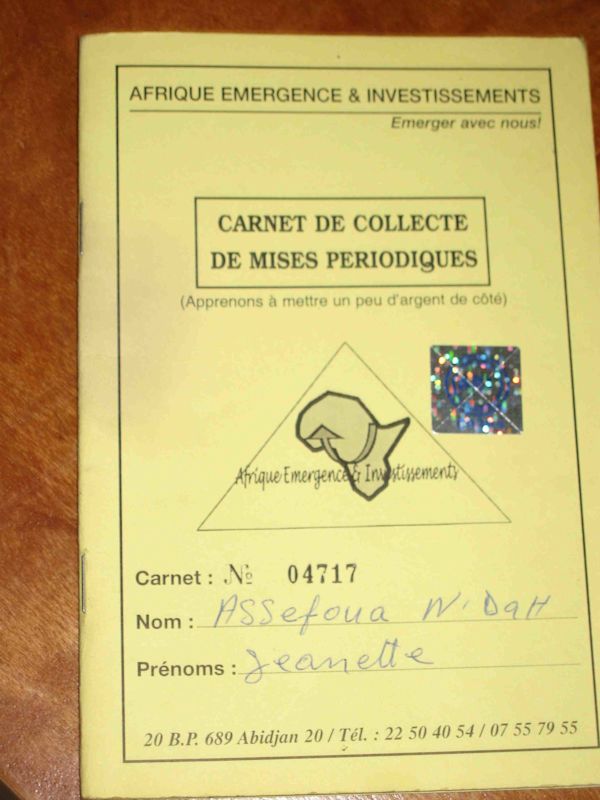

Savings and loan payments are tracked in a passbook that the borrower keeps. They pay 1000 CFA (about $2) for the passbook, so that they are careful not to lose it. When the clients make their deposit each day, they receive a hologrammed sticker for that payment in the passbook. There are different colored stickers, each with a different monetary value. This makes it easy to add up the amount contributed each month by counting up the stickers, and multiplying by the value of their color. The stickers allow borrowers, even those who cannot read and write, to track their savings, withdrawals, and loan payments easily.

In a country where corruption claims so much money, AE&I has set up a strong infrastructure to protect their clients and ensure the quality of each of their loans. Each transaction is documented in several steps, with cross checks between the computer system and handwritten logbooks. The Internal Auditor tracks the amount of stickers that are used by each loan officer on a weekly basis, and matches that number with the deposits and loan payments. And the Internal Auditor also visits clients in the market to follow up on late loan payments, and also spot checks to see that the passbooks match the loan records at the office. Microfinance is such a simple concept, but seeing the operations in the field has given me a deep appreciation for the complexity of its execution.

/>