CERISE: A Model for Maintaining Trajectory

November 9, 2010

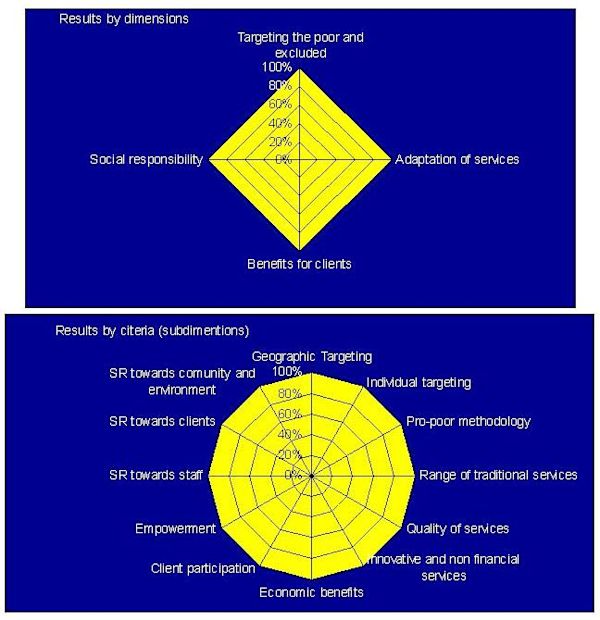

My main assignment at EDPYME Alternativa has been to complete a social performance audit using the model provided by the organization CERISE. The description “social performance audit” is a bit misleading, The work does not consist of checking in with individual borrowers to see if their lifestyle has improved. I am not compiling data about the number of borrowers who have improved their homes, sent their children to school, received medical attention, been able to raise more chickens, or any number of other improvements that a borrower may realize in their or their family’s lives.

Instead, the social performance audit is a review of the organization’s controls, policies and practices that provide for the protection of stakeholders and for the development of local communities.

If used well, the study provides the opportunity for an institution to adjust their trajectory in order to get closer to the mark: social improvement through economic activity. Each question hones down on deeper issues of social responsibility, equality and justice. The study can provide a new institution with a framework for setting their sights and an old institution with an opportunity to revise their trajectory.

Examples of questions include:

- What percentage of clients come from underdeveloped areas?

- Does the institution use a targeting tool to select poor clients? How does it ensure that the tool is properly used?

- How does the institution obtain updates on satisfaction and status of its clients?

- Does the institution offer services adapted specifically to the needs of its clients?

- How does the institution ensure that its services are adapted to client’s needs?

- Does the institution follow the economic status changes of its clients?

- Do clients participate in management decisions or the direction of the institution?

- Does the institution take actions to avoid over-indebtedness? If so, what actions?

- Does the institution provide to its clients, in written form, understandable information about costs, rights and penalties?

- Do credit officers explain contracts, rules, charges and rights to each client?

- How does the institution ensure that illiterate borrowers understand the terms of their loans and their rights?

- Does the institution have written policies regarding social responsibility? What does it include?

- Does the institution have policies protecting client privacy? What measures are taken to protect privacy? What options does the client have to deny sharing of information?

- Does the institution have a policy to protect the environment?

- Are trainings available to all categories of employees?

- Is there a written salary schedule for the various levels of employees which is transparent and accessible for all employees?

In the case of Edpyme Alternativa, I am getting to watch them begin to refocus on their social responsibility. Their growth from a small institution to a formidable market competitor came so fast that they out grew some of their internal regulatory structures and policies. They are now having to sit down, review their status and formalize their policies. I believe that the results of the CERISE Social Performance Audit and the conversations I have had with individual members of the staff will provide a framework that Edpyme Alternativa can use to improve their review process and create policies that will stand the tests of time. The CERISE Social Performance Audit will serve an important role in helping Edpyme Alternativa adjust its course and maintain its trajectory towards becoming a valuable leader in the realm of Peruvian microfinance.

Casey Unrein KF 12 joined the Kiva Fellows program in Sept. 2010. Prior to becoming a Fellow, Casey worked with a fiduciary management company in Seattle, WA, providing financial management services for minors, the elderly and the disabled. Casey completed a bachelors in Economics and Education at Occidental College. He expects to become a certified public accountant by then end of 2010. Casey is currently a Fellow with EDPYME Alternativa in Chiclayo, Peru. Please support Kiva.org and EDPYME Alternativa by joining lending teams and expanding the community. You can join Friends of EDPYME Alternativa by clicking on the link.

PREVIOUS ARTICLE

A week in my life.. →NEXT ARTICLE

Passport Series: The Microfinance Industry in Rwanda →