By Gabriel Francis, Kiva Fellow class 12, FUDECOSUR Costa Rica

With few exceptions, wherever you are in the world there is a McDonalds nearby. From Bucharest to Bangladesh every restaurant has some variation of the classic hamburger, the Big Mac.

So what does a hamburger have to do with Micro-Finance?

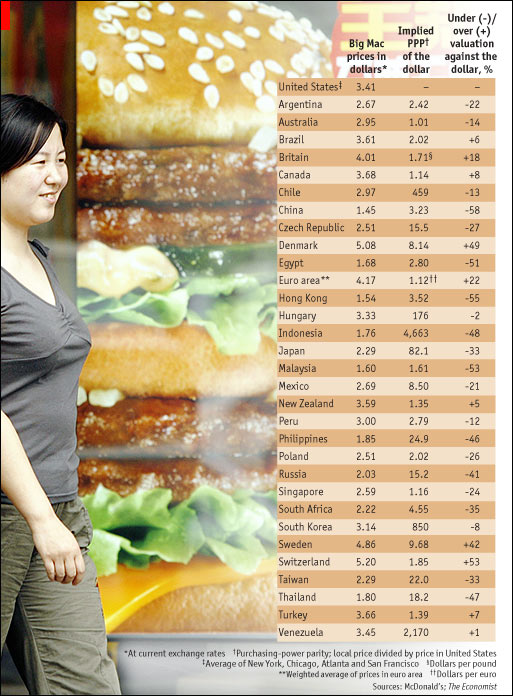

More than you might think. Some clever economists at The Economist Group have found the price of the universal hamburger is a good indicator of future exchange rates. Their research, compiled in the monthly Big Mac Index, is a tongue-in-cheek attempt to gauge the fair value of a currency against the dollar. For example, in Thailand a Big Mac costs 70 bhat, or $2.17. Compared to the base cost of a hamburger in the United States $3.73, hamburgers in Thailand are under-valued. And that means, at least according to the Big Mac Index, so is the bhat.

Kiva deals in dollars with its 119 partners in 53 countries so the local exchange rate has a direct relationship to the health of a partner’s loan portfolio. Could it be possible to predict the financial risk of Kiva’s micro-finance field partners using the Big Mac Index as proxy?

I don’t usually eat at McDonalds but yesterday I stopped in to the local fast food franchise in San Isidro, Costa Rica to check on prices. A hamburger here costs 2,000 colones. Or, $3.96 at current exchange. According the the Big Mac index that means the Costa Rican colon is 6% over value.

The Costa Rica bank seems to agree. Lately, they’ve been purchasing dollars like mad in an attempt to hault a slow slide to 500. At time of writing the exchange is 504 colones per dollar, down from 580 at the same time last year. That means my dollar buys 13% less hamburgers than it would have a year ago.

While I lament the increasing cost of lunch, for Kiva’s Field Partners and lenders who hold tens of thousands of dollars in outstanding loans in dollars these fluctuations mean big risks. When the dollar is expensive, times are bad. Sometimes very bad. But when the dollar is cheap, times are good.

Recently, my MFI partner FUDECOSUR has recently been quietly celebrating. Their loan repayments, collected in colones but paid in dollars, are feeling the reverse benefits of a weak dollar. As the dollar gets cheaper so do their loan repayments to Kiva. Any positive difference between the original loan disbursement amount and the loan repayment amount is theirs to keep. A bonus for coming out on top in the international exchange lottery.

Now consider the reverse case, where the dollar suddenly becomes much more expensive. Just a few years ago in Zimbabwe, before they switched to the dollar, inflation reached heights of 516 Quintillion Percent. That means, in the worst case scenario one dollar could potentially cost 516 and 18 zeroes more by the time of repayment a year later. Today Zimbabwe’s out of print 100 trillion dollar notes sell on eBay for around $3 each.

To protect it’s partners from the risks of such catastrophic inflation, Kiva offers it’s field partners an optional protection on any inflation beyond 20%. If the MFI elects this option, they agree to bear all currency losses up until 20% inflation. After that, if the value of the U.S. dollar appreciates more than 20%, the Kiva lenders will bear the loss.

To drive the point home, let’s walk through a fictional example. Say a $1000 loan is funded in the fictional country of Burgerlandia where the currency is hamburgers. At the time of loan distribution $1 buys 500 hamburgers. One year later the loan is due. Unfortunately, there has been a obesity epidemic and the demand for burgers has fallen. To the chagrin of the field partner it now takes 625 hamburgers to buy $1. The partner still owes $1000 but it now costs them 25% more than they received. In this case, if the partner had elected for currency protection the Kiva lenders would absorb 5% of this loss. That’s a lot of hamburgers, but at least the partner didn’t completely default.

Currency loss protection is a hotly debated topic at Kiva and among our Kiva friends. As many fellows before have pointed out before. It is certain that sharing currency loss increases the financial risk to Kiva Lenders. However, for those that see micro-finance as a largely social venture currency loss protection is a way to distribute risk among all participants in a loan. Theoretically this might allow Kiva’s partners to charge lower interest rates or protect them from total default in the case of Zimbabwe-like inflation.

Whichever side of the debate you come out on one thing is clear. After reading this post, you’ll never again think of a hamburger as just another fast food.

Gabriel Francis is currently serving as a Kiva Fellow at FUDECOSUR in southern Costa Rica. When he isn’t digging a 4×4 vehicle out of the mud in the middle of a pinneapple field, you can find him riding the waves of Dominical beach or curled up with his friends Borges, Orwell, and Vonnegut.

Lend to a FUDECOSUR entrepreneur today!

PREVIOUS ARTICLE

Peace, Love, and Platanos – video recap of a recent visit to three ECCs →NEXT ARTICLE

Come Join the Kiva Team! →