By Sally Bolton, KF11 Mexico

In June 1986 during the football World Cup in Mexico many people around the world saw a stadium wave for the first time. In many countries this phenomenon became known as a Mexican wave. In June 2010 a borrower in Mexico saw Kiva’s new client waiver for the first time. This is the story of the waiver, not the wave.

“I’m so happy that you can come with me to Tlalnepantla today,” said Leti, the loan officer I was working with last week. “There’s a group there who don’t want to enter into Kiva for their second loan cycle. Maybe you can convince them that they should.”

Convince them? I wasn’t sure that was my role. Leti explained that a few of the group members didn’t want to appear on the Kiva website given the drug violence and fragile security situation in Mexico. They were concerned that appearing on Kiva might put them at risk.

On one hand I was really happy to know that the group had been fully informed about what it means to receive a Kiva loan. All borrowers must sign a Kiva Client Waiver, indicating that they are aware that their photo and story will be published on the Kiva website. But a signed form doesn’t necessarily mean that the borrower fully understands how Kiva works. Most borrowers will happily sign every form that is put in front of them so they can receive their loan. They often don’t read the forms closely, or perhaps they can’t read them. So it is important that the loan officer explains to them exactly what it means to ‘enter into Kiva’.

If the group members had legitimate safety and security concerns about appearing on Kiva, I definitely wanted to respect those concerns. On the other hand, it would mean more work for Leti if the group chose not to enter into Kiva. She would then need to identify another group who could receive a Kiva loan.

Kiva assigns each of its field partners a monthly fundraising limit, and Fundacion Realidad A.C. (FRAC) needs to raise 80% of this limit for three consecutive months in order to move from pilot to active phase. It can take quite a lot of work to identify groups that qualify for a Kiva loan. Many of FRAC’s loans don’t qualify. As clients increase the amount of money they borrow through additional loan cycles, their loans often become too large for Kiva.

We arrived in Tlalnepantla, Morelos, a pretty hillside village surrounded by thousands of hectares of nopal (edible cactus) fields. Leti introduced me to Felipa, one of the members who was unsure about this whole Kiva business. “Sally’s from Kiva, and she’s come all the way from Australia to Tlalnepantla to convince you that you should enter into Kiva,” Leti said.

I smiled nervously, unsure of how Felipa would receive me. I started by asking her to tell me about her concerns with appearing on the Kiva website. She was worried that anyone could see that she had received money and come to Tlalnepantla to steal that money from her. I explained that there are privacy measures that Kiva uses to protect the identity of borrowers if required, for example by not revealing the full name or location of the borrower.

I then showed her a print-out of the group’s profile from their first loan. She looked over it with interest, as I pointed out the group’s photo, story in English and Spanish, and the names of all of the Kiva lenders who had supported their loan. “But I’m not in the photo!” she exclaimed. It turned out Felipa had not been able to attend the meeting when the group photo was taken. “I’d like to be in the photo next time!”

It was amazing to see how quickly she changed her mind once she understood more about how Kiva works. She happily signed the client waiver, and asked if she could keep the print-out as a ‘souvenir of Kiva’, to show her family and the rest of the group.

We all left the meeting with big smiles on our faces. I asked Leti if she thought there was any security risk to borrowers by publishing their photos and stories on Kiva. She said no, but for clients who have never had access to credit before, it’s understandable that suddenly having a significant sum of cash would make them nervous.

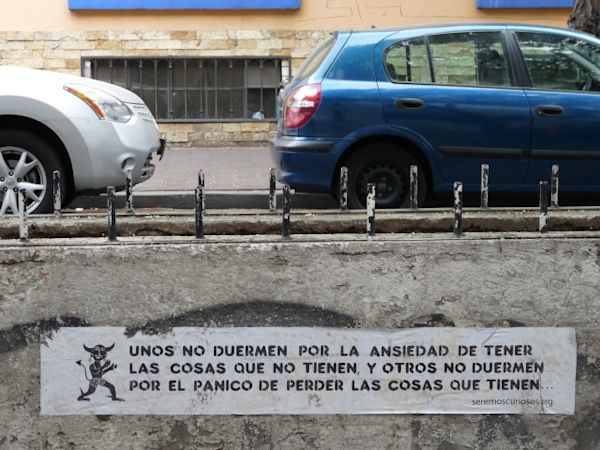

This reminded me of some street art I had seen in my neighbourhood, a quote from the Uruguayan writer Eduardo Galeano. It reads: Some people don’t sleep worrying about the things they don’t have, and others don’t sleep panicking about losing the things they do have. I hope that as Felipa moves forward with her business she can find the middle ground.

Want to support entrepreneurs like Felipa who share their stories with Kiva? Visit the Kiva website now to make a loan: www.kiva.org/lend

PREVIOUS ARTICLE

What we can learn from La Paz’s zebras: A guide for future Kiva fellows →NEXT ARTICLE

Do the poor have dreams?/ A quoi rêvent les pauvres? →